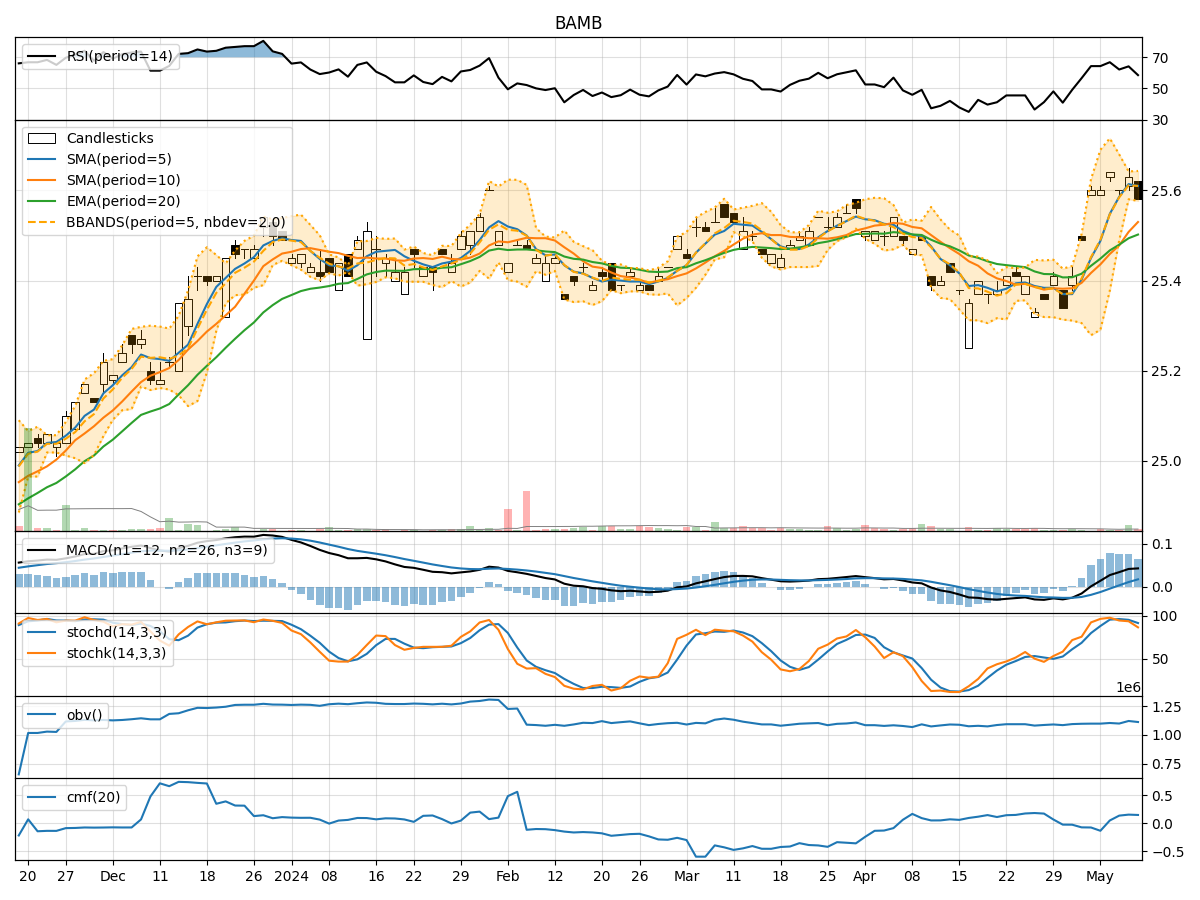

Technical Analysis of BAMB 2024-05-10

Overview:

In analyzing the technical indicators for BAMB stock over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days. By examining these key aspects, we aim to offer valuable insights and predictions for potential investors.

Trend Analysis:

- Moving Averages (MA): The 5-day Moving Average (MA) has been consistently above the Simple Moving Average (SMA) and Exponential Moving Average (EMA), indicating a bullish trend.

- MACD: The MACD line has been consistently above the signal line, with both lines showing an upward trend, suggesting bullish momentum.

Momentum Analysis:

- RSI: The Relative Strength Index (RSI) has been fluctuating around the 60-70 range, indicating a neutral momentum.

- Stochastic Oscillator: Both %K and %D have been gradually decreasing, signaling a potential reversal in momentum to the downside.

Volatility Analysis:

- Bollinger Bands (BB): The stock price has been trading within the Bollinger Bands, with the bands narrowing, suggesting decreasing volatility.

Volume Analysis:

- On-Balance Volume (OBV): The OBV has been showing mixed signals, indicating indecision among investors.

- Chaikin Money Flow (CMF): The CMF has been positive, suggesting buying pressure in the stock.

Key Observations:

- The trend indicators point towards a bullish sentiment in the short term.

- Momentum indicators show a potential shift towards a bearish momentum.

- Volatility is decreasing, indicating a possible period of consolidation.

- Volume indicators suggest mixed signals, reflecting uncertainty among market participants.

Conclusion:

Based on the analysis of the technical indicators, the next few days for BAMB stock could see sideways movement with a slight bearish bias. Investors should exercise caution and closely monitor the price action for any potential trend reversal. It is advisable to wait for more clarity in the market dynamics before making significant trading decisions.