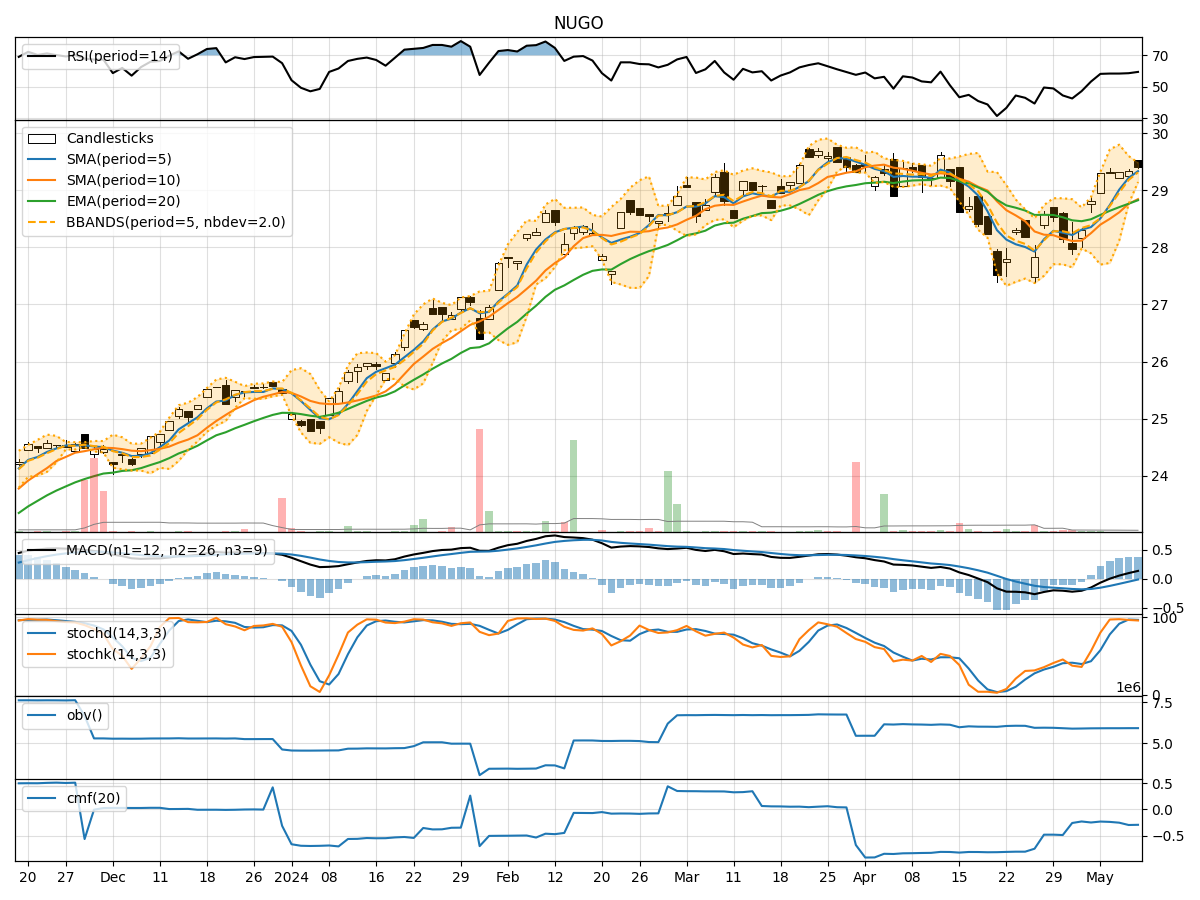

Technical Analysis of NUGO 2024-05-10

Overview:

In analyzing the technical indicators for NUGO stock over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days. By examining key metrics such as moving averages, MACD, RSI, Bollinger Bands, and OBV, we aim to offer valuable insights and predictions for potential price trends.

Trend Indicators:

- Moving Averages (MA): The 5-day MA has been consistently rising, indicating a bullish trend in the short term.

- MACD: The MACD line has been above the signal line, suggesting positive momentum.

- EMA: The EMA has been trending upwards, supporting the bullish sentiment.

- Conclusion: The trend indicators point towards an upward movement in the stock price.

Momentum Indicators:

- RSI: The RSI has been increasing, but not in the overbought territory yet, indicating room for further upside.

- Stochastic Oscillator: Both %K and %D have been high, signaling strong buying pressure.

- Williams %R: The indicator has been in the oversold region, potentially indicating a reversal.

- Conclusion: Momentum indicators suggest a bullish momentum in the stock.

Volatility Indicators:

- Bollinger Bands: The stock price has been trading near the upper band, indicating increased volatility.

- Conclusion: Volatility is present in the stock, which could lead to sharp price movements in the coming days.

Volume Indicators:

- On-Balance Volume (OBV): The OBV has been increasing, reflecting accumulation by investors.

- Chaikin Money Flow (CMF): The CMF has been negative, indicating selling pressure.

- Conclusion: Volume indicators show a mixed signal, with OBV suggesting accumulation while CMF indicates selling pressure.

Overall Conclusion:

Based on the analysis of trend, momentum, volatility, and volume indicators, the overall outlook for NUGO stock is bullish. The trend is upward, momentum is positive, and volatility is present, potentially leading to significant price movements. While volume indicators show a mixed signal, the overall technical picture favors a continued upward movement in the stock price in the next few days.

Recommendation:

Considering the bullish trend and positive momentum, investors may consider buying NUGO stock for potential short to medium-term gains. However, it is essential to monitor the volatility and volume dynamics closely to manage risks effectively. As always, it is advisable to conduct further research and consider fundamental factors before making any investment decisions.