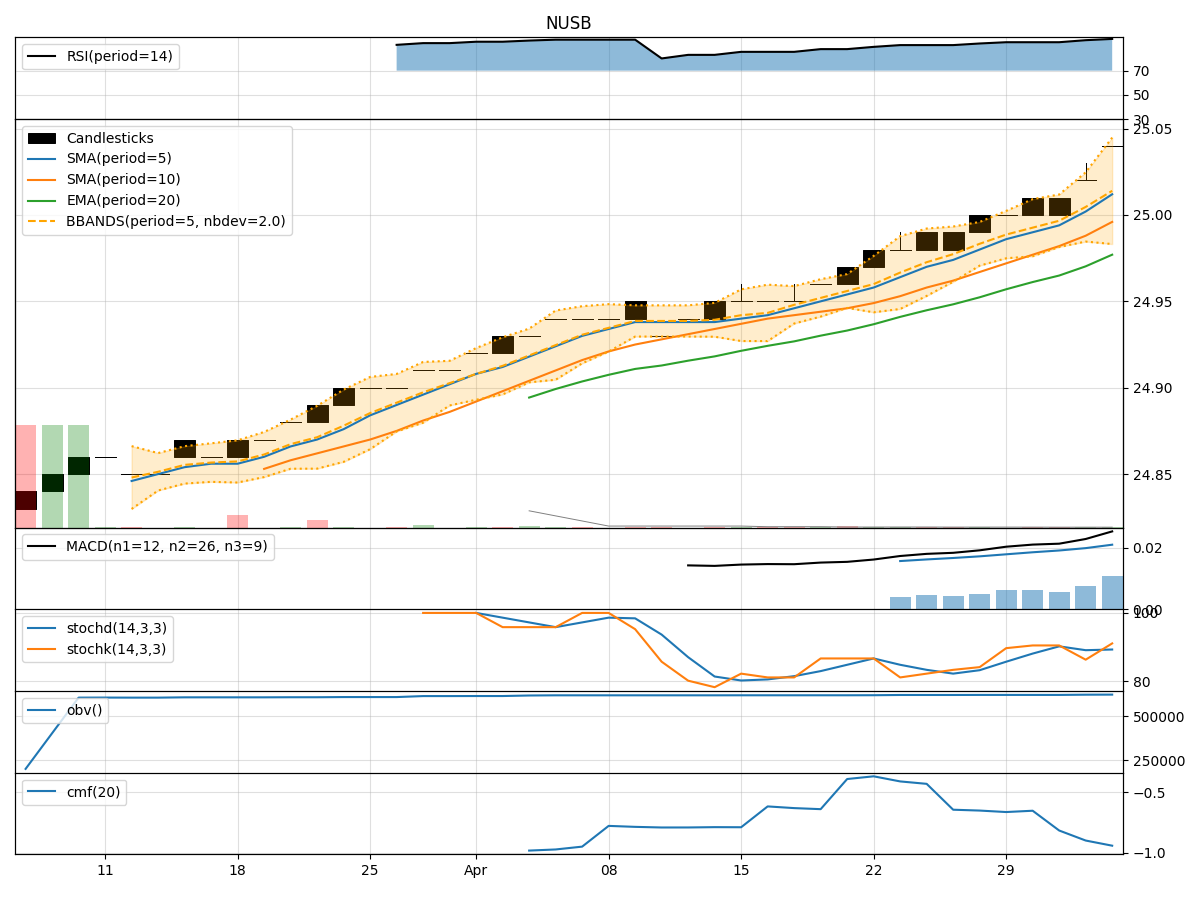

Technical Analysis of NUSB 2024-05-10

Overview:

In analyzing the technical indicators for NUSB over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days.

Trend Indicators:

- Moving Averages (MA): The 5-day MA has been consistently above the closing price, indicating a short-term uptrend.

- MACD: The MACD line has been positive and increasing, suggesting bullish momentum.

- EMA: The EMA has been trending upwards, supporting the bullish sentiment.

Key Observation: The trend indicators point towards a bullish outlook for NUSB.

Momentum Indicators:

- RSI: The RSI has been in the overbought territory, indicating strong buying momentum.

- Stochastic Oscillator: Both %K and %D have been relatively high, signaling potential overbought conditions.

- Williams %R: The indicator has been hovering near the oversold region, suggesting a possible reversal.

Key Observation: Momentum indicators suggest a mixed sentiment with potential for a pullback due to overbought conditions.

Volatility Indicators:

- Bollinger Bands (BB): The price has been trading within the upper Bollinger Band, indicating increased volatility.

- BB Width: The width of the bands has been expanding, suggesting heightened price fluctuations.

Key Observation: Volatility indicators imply increased volatility in the stock.

Volume Indicators:

- On-Balance Volume (OBV): The OBV has been relatively flat, indicating a balance between buying and selling pressure.

- Chaikin Money Flow (CMF): The CMF has been negative, reflecting a lack of buying pressure.

Key Observation: Volume indicators suggest neutral sentiment with no clear direction.

Conclusion:

Based on the analysis of the technical indicators, the bullish trend indicators are countered by the mixed momentum indicators and increased volatility. The neutral volume indicators further add to the uncertainty.

Overall Assessment: The next few days for NUSB could see increased volatility with a potential for a pullback in price due to overbought conditions. Traders should exercise caution and consider implementing risk management strategies in this uncertain market environment.

Recommendation: It is advisable to closely monitor price action, key support and resistance levels, and any developments in market sentiment to make informed trading decisions. Consider setting stop-loss orders to manage risk effectively in this volatile period.

Key Words: Increased Volatility, Potential Pullback, Exercise Caution.