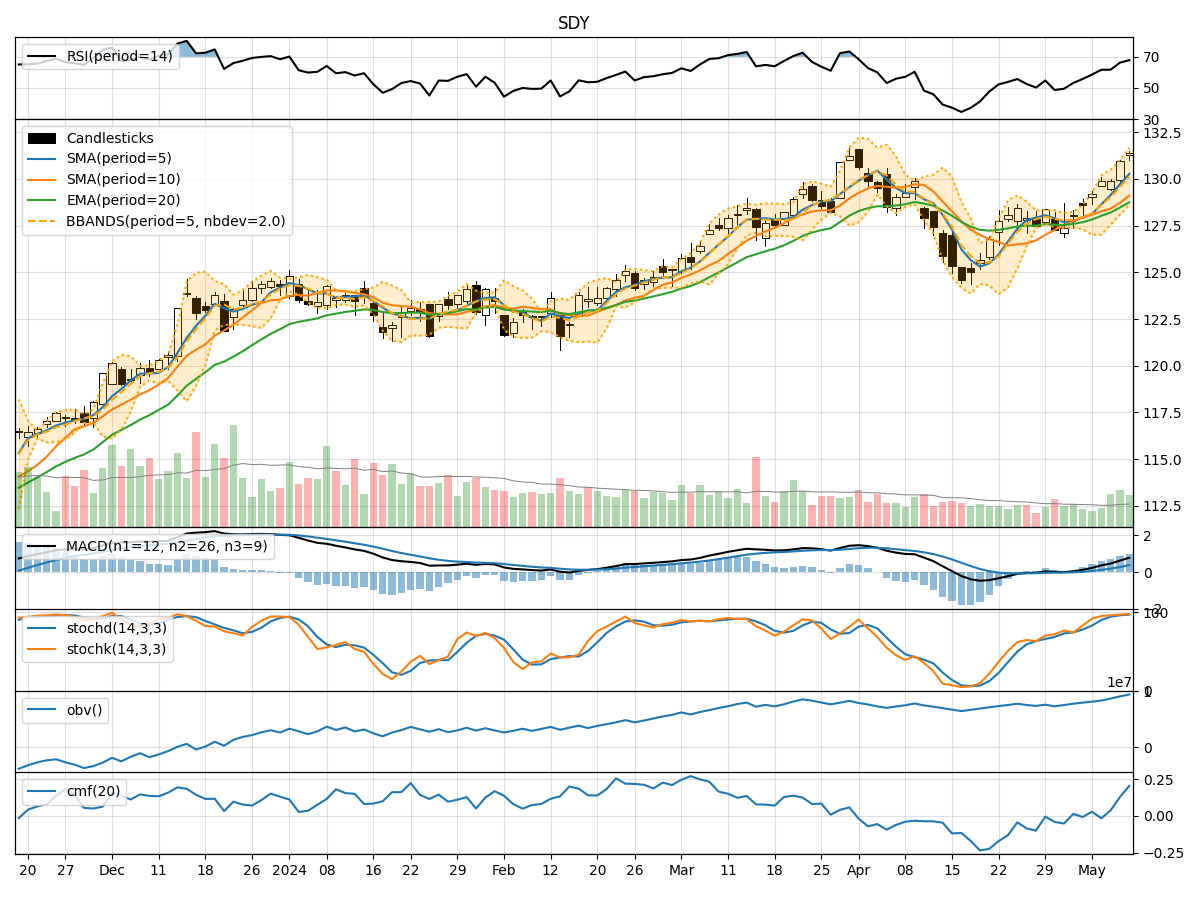

Technical Analysis of SDY 2024-05-10

Overview:

In analyzing the technical indicators for SDY over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days.

Trend Indicators:

- Moving Averages (MA): The 5-day MA has been consistently above the closing prices, indicating a bullish trend.

- MACD: The MACD line has been above the signal line, suggesting a bullish momentum.

- EMA: The exponential moving average has been trending upwards, supporting the bullish sentiment.

Momentum Indicators:

- RSI: The RSI has been in the overbought territory, indicating a strong bullish momentum.

- Stochastic Oscillator: Both %K and %D have been in the overbought zone, signaling a potential reversal.

- Williams %R: The indicator has been consistently in the oversold region, suggesting a bearish sentiment.

Volatility Indicators:

- Bollinger Bands: The stock price has been trading within the bands, indicating a period of consolidation.

- Bollinger %B: The %B value has been fluctuating around 0.8, suggesting a stable price movement.

Volume Indicators:

- On-Balance Volume (OBV): The OBV has been steadily increasing, indicating accumulation by investors.

- Chaikin Money Flow (CMF): The CMF has been positive, reflecting buying pressure in the stock.

Key Observations:

- The trend indicators point towards a bullish sentiment with moving averages and MACD supporting an upward trajectory.

- Momentum indicators show conflicting signals with RSI in overbought territory but stochastic oscillators hinting at a potential reversal.

- Volatility indicators suggest a period of consolidation with the stock price trading within the Bollinger Bands.

- Volume indicators indicate accumulation by investors and positive buying pressure.

Conclusion:

Based on the analysis of the technical indicators, the stock is likely to experience a period of consolidation in the near term. The conflicting signals from momentum indicators suggest a potential reversal or a brief pullback in the bullish trend. Investors should closely monitor the price action within the Bollinger Bands and the stochastic oscillators for confirmation of a trend reversal. Exercise caution and consider taking profits or implementing risk management strategies in anticipation of a possible correction in the stock price.