Technical Analysis of UVXY 2024-05-10

Overview:

In analyzing the technical indicators for UVXY over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days. By examining these key aspects, we aim to offer valuable insights and predictions to guide your investment decisions.

Trend Analysis:

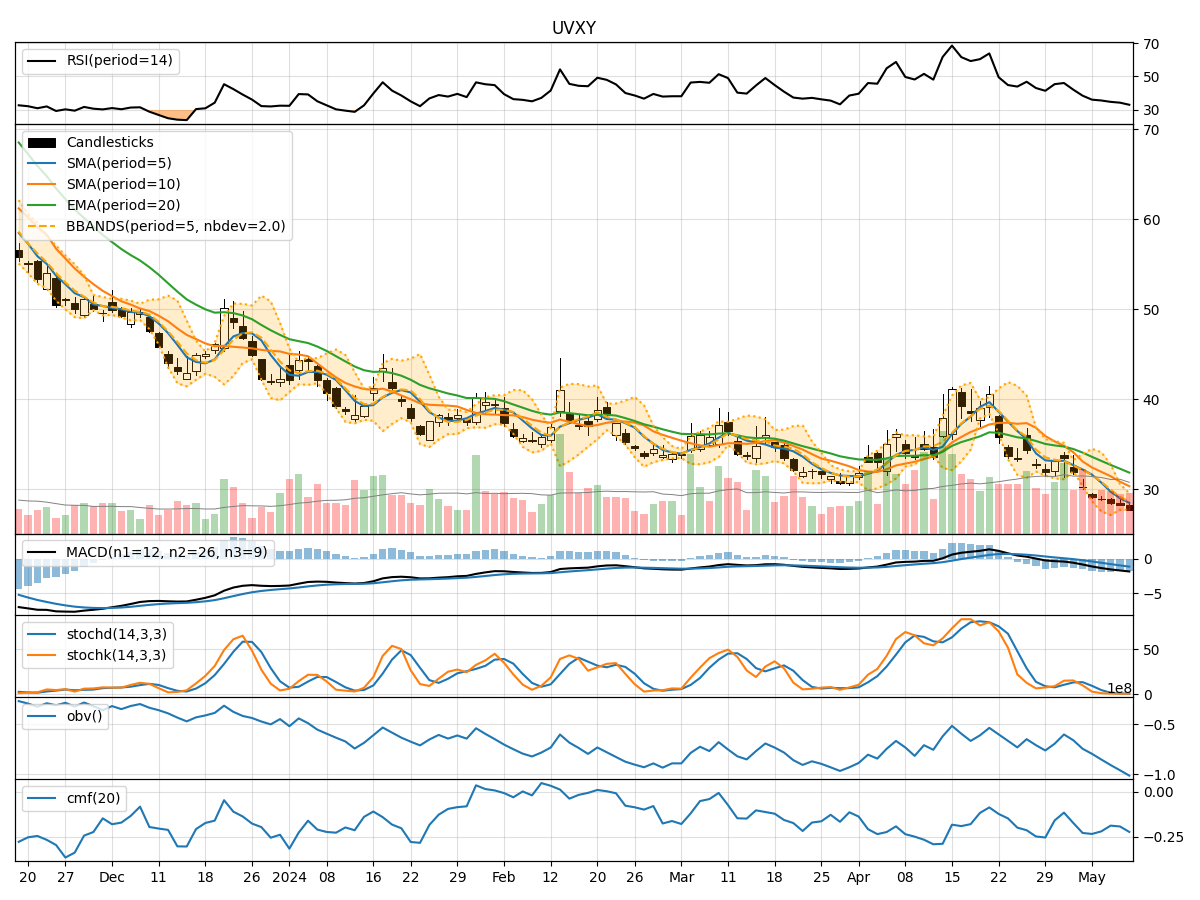

- Moving Averages (MA): The 5-day MA has been consistently below the longer-term SMAs and EMAs, indicating a downward trend.

- MACD: The MACD line has been decreasing, with the MACD line consistently below the signal line, suggesting bearish momentum.

Key Observation: The trend indicators point towards a downward trajectory for UVXY.

Momentum Analysis:

- RSI: The RSI has been declining and is currently below 50, indicating weakening momentum.

- Stochastic Oscillator: Both %K and %D have been decreasing, signaling a potential oversold condition.

Key Observation: Momentum indicators suggest a bearish sentiment in the market.

Volatility Analysis:

- Bollinger Bands (BB): The price has been consistently below the middle BB, indicating a lack of volatility.

Key Observation: Volatility indicators reflect a sideways or consolidation phase for UVXY.

Volume Analysis:

- On-Balance Volume (OBV): The OBV has been declining, indicating selling pressure.

- Chaikin Money Flow (CMF): The CMF has been negative, suggesting outflow of money from the stock.

Key Observation: Volume indicators support a bearish outlook for UVXY.

Conclusion:

Based on the analysis of trend, momentum, volatility, and volume indicators, the overall outlook for UVXY in the next few days is bearish. The trend is downward, momentum is weakening, volatility is low, and volume is indicating selling pressure. Therefore, it is likely that UVXY will experience further downside movement in the coming days.

Key Conclusion:

The technical analysis suggests that UVXY is likely to continue its downward trend in the near future. Investors should exercise caution and consider potential short positions or wait for a more favorable entry point before considering long positions.