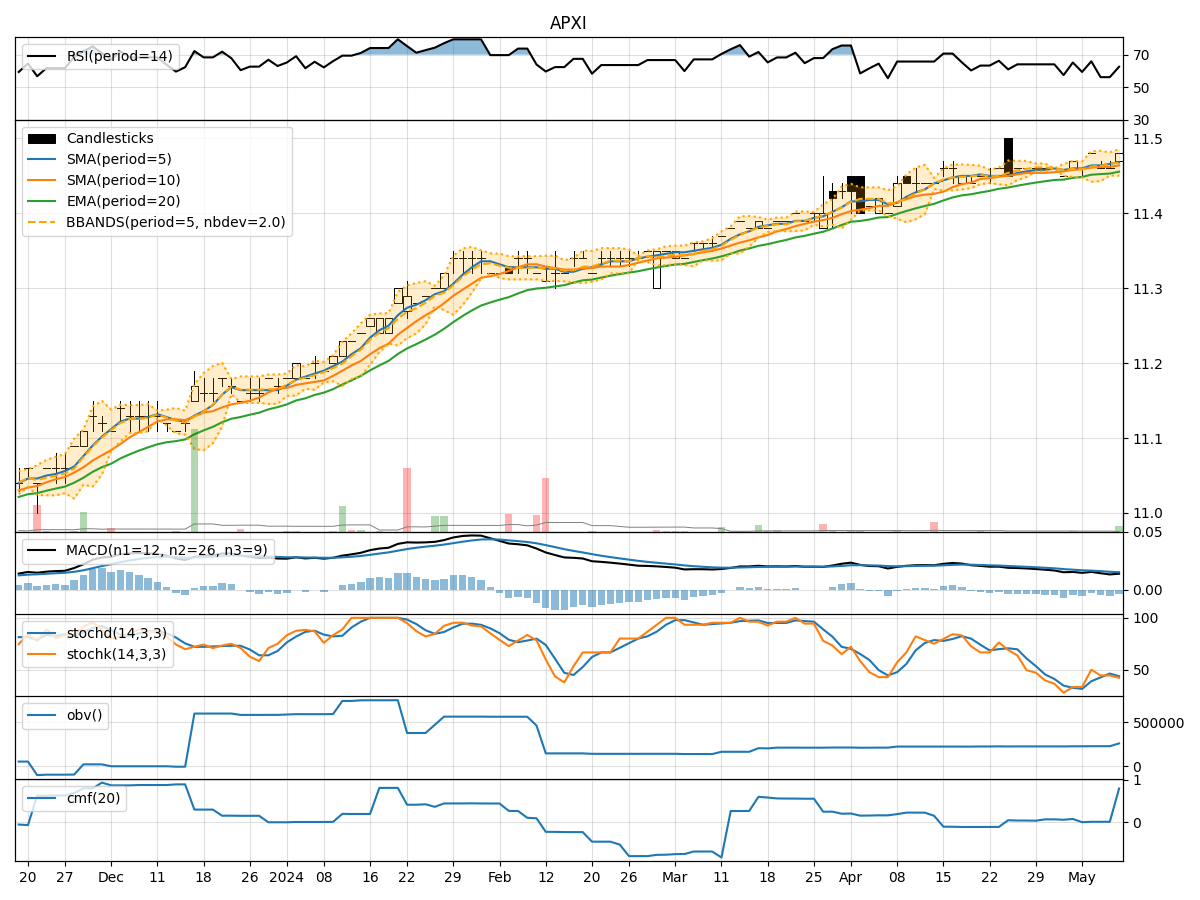

Technical Analysis of APXI 2024-05-31

Overview:

In analyzing the technical indicators for APXI over the last 5 days, we will delve into the trends, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days. By examining these key aspects, we aim to offer valuable insights and recommendations for potential investors.

Trend Analysis:

- Moving Averages (MA): The 5-day Moving Average has been steadily increasing, indicating a positive trend in the short term.

- MACD: The MACD line has been consistently above the signal line, suggesting bullish momentum.

Key Observation: The trend indicators point towards an upward movement in the stock price.

Momentum Analysis:

- RSI: The Relative Strength Index has been increasing and is now in the overbought territory, signaling potential strength in the stock.

- Stochastic Oscillator: Both %K and %D have been high, indicating strong buying momentum.

Key Observation: Momentum indicators suggest a bullish sentiment in the stock.

Volatility Analysis:

- Bollinger Bands: The stock price has been trading close to the upper Bollinger Band, indicating increased volatility.

Key Observation: Volatility indicators show an increased level of volatility in the stock.

Volume Analysis:

- On-Balance Volume (OBV): The OBV has been increasing, reflecting higher buying volume in the stock.

- Chaikin Money Flow (CMF): The CMF is positive, indicating money flow into the stock.

Key Observation: Volume indicators suggest positive buying interest in the stock.

Conclusion:

Based on the analysis of the technical indicators, the overall outlook for APXI is bullish. The trend indicators, momentum indicators, and volume indicators all point towards a potential upward movement in the stock price. However, the increased volatility as indicated by the Bollinger Bands suggests that there may be fluctuations in the price.

Recommendation: Considering the bullish sentiment and positive momentum, investors may consider buying APXI for potential short to medium-term gains. It is essential to monitor the price action closely and set appropriate stop-loss levels to manage risks effectively.