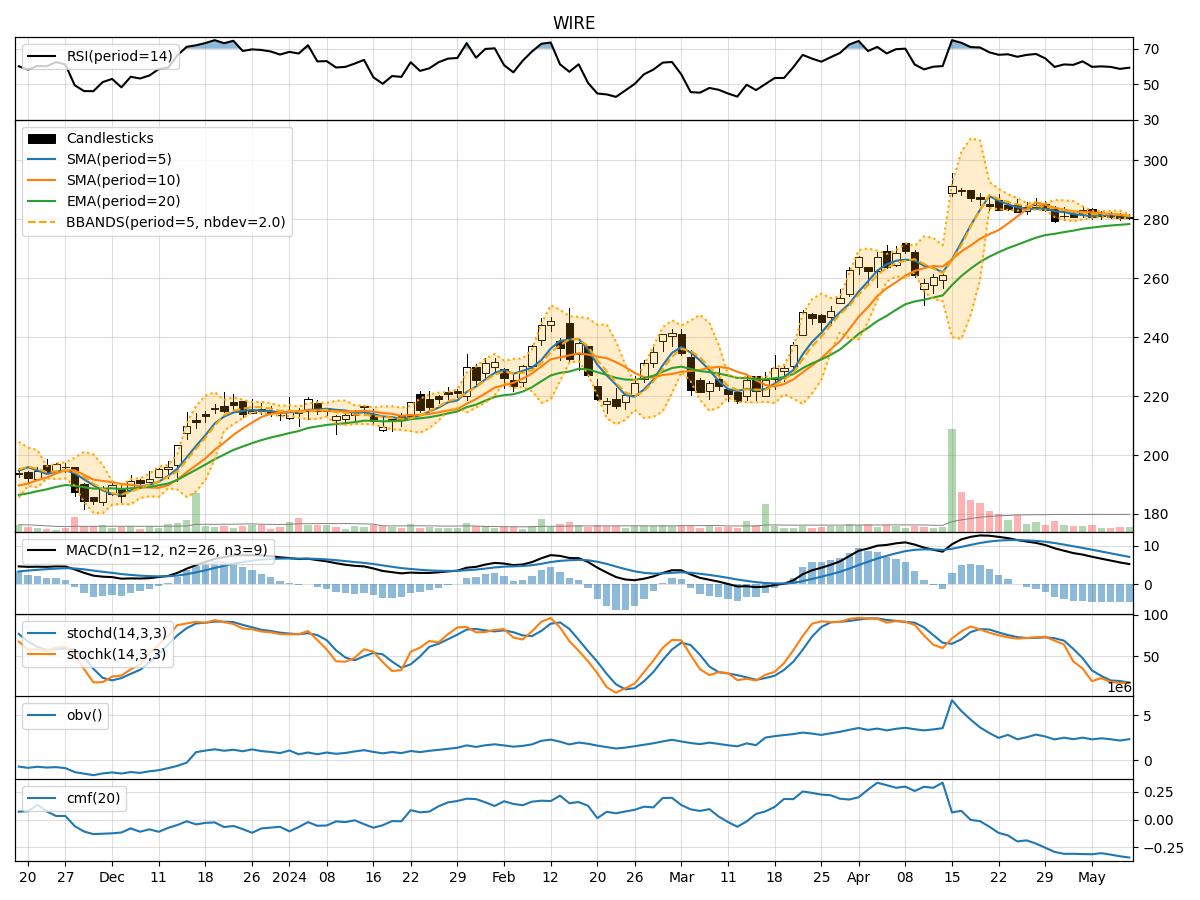

Technical Analysis of WIRE 2024-05-10

Overview:

In analyzing the technical indicators for WIRE stock over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible future stock price movement. By examining these key indicators, we aim to offer valuable insights and recommendations for potential investors.

Trend Analysis:

- Moving Averages (MA): The 5-day Moving Average (MA) is slightly below the Simple Moving Average (SMA) and Exponential Moving Average (EMA), indicating a short-term downward trend.

- MACD: The MACD line is decreasing, and the MACD Histogram is also showing a decline, suggesting a weakening bullish momentum.

- Conclusion: The trend indicators point towards a bearish sentiment in the short term.

Momentum Analysis:

- RSI: The Relative Strength Index (RSI) is hovering around 60, indicating a neutral momentum.

- Stochastic Oscillator: Both %K and %D are relatively low, suggesting a lack of strong buying pressure.

- Conclusion: The momentum indicators reflect a neutral stance with a slight bearish bias.

Volatility Analysis:

- Bollinger Bands (BB): The stock price is currently within the Bollinger Bands, with the bands narrowing, indicating decreasing volatility.

- Conclusion: Volatility is decreasing, signaling a consolidation phase in the stock price.

Volume Analysis:

- On-Balance Volume (OBV): The OBV is showing a slight decrease, indicating some selling pressure.

- Chaikin Money Flow (CMF): The CMF is negative, suggesting a bearish money flow.

- Conclusion: Volume indicators suggest a bearish sentiment in the market.

Conclusion:

Based on the analysis of trend, momentum, volatility, and volume indicators, the overall outlook for WIRE stock in the next few days is bearish. The trend is downward, momentum is neutral with a bearish bias, volatility is decreasing, and volume indicators point towards selling pressure. Therefore, it is likely that the stock price may experience a downward movement in the upcoming days.

Recommendation:

Investors should exercise caution and consider waiting for more favorable conditions before entering a long position. It is advisable to closely monitor the stock price for any potential reversal signals before making any trading decisions. Additionally, conducting further research and analysis on fundamental factors impacting the stock can provide a more comprehensive view for informed investment strategies.