Technical Analysis of MO 2024-05-03

Overview:

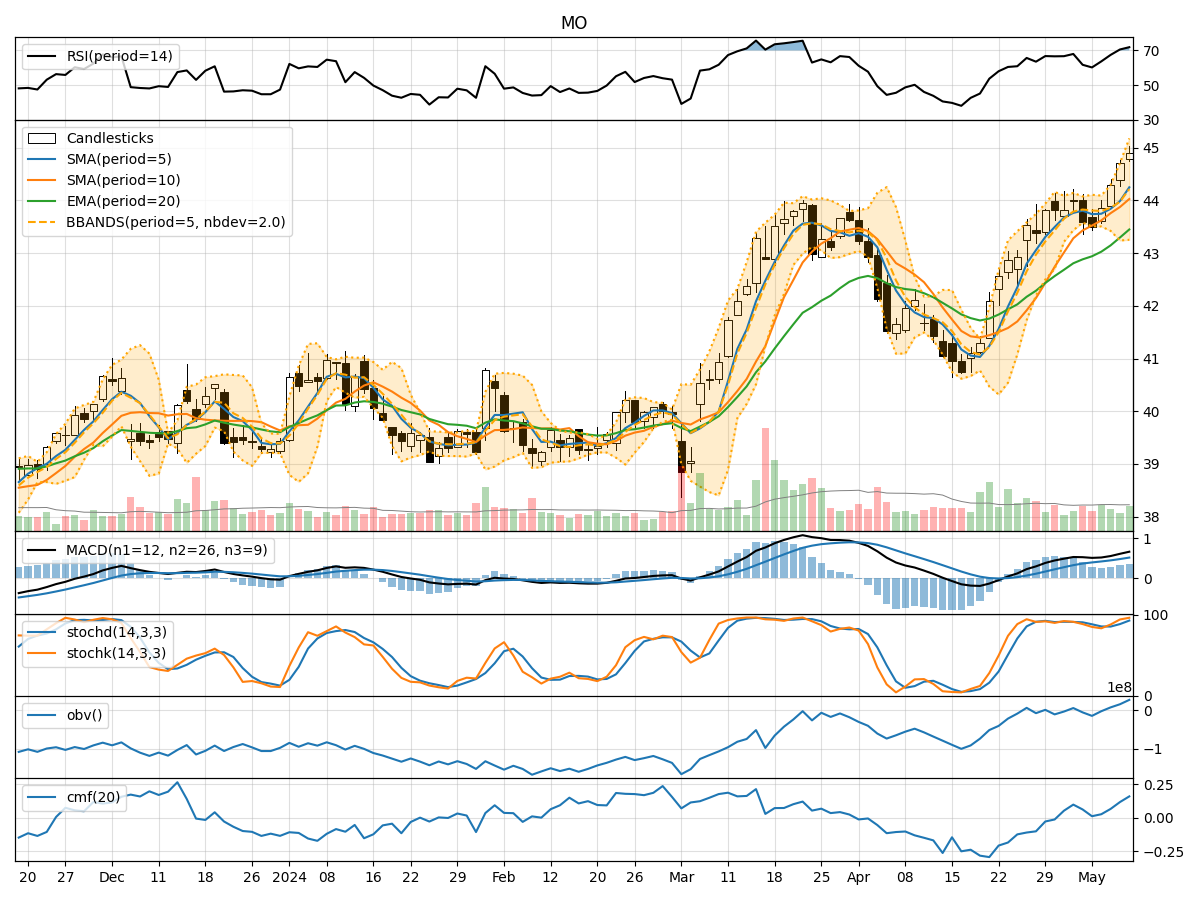

In analyzing the technical indicators for MO (Altria Group Inc.) over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days.

Trend Analysis:

- Moving Averages (MA): The 5-day Moving Average (MA) has been consistently above the Simple Moving Average (SMA) and Exponential Moving Average (EMA), indicating a bullish trend.

- MACD: The MACD line has been consistently above the signal line, with both lines showing an upward trend, suggesting bullish momentum.

- Momentum: The Relative Strength Index (RSI) has been fluctuating around the overbought territory, indicating strong buying pressure.

- Volatility: The Bollinger Bands (BB) have been relatively narrow, suggesting low volatility in the stock price.

Key Observations:

- The stock is in an upward trend based on moving averages and MACD.

- Momentum indicators like RSI show overbought conditions, indicating a potential pullback.

- Volatility is low, indicating a possible period of consolidation.

Conclusion:

Based on the technical indicators analyzed, the next few days for MO stock are likely to see a consolidation phase with a potential short-term pullback due to overbought conditions. However, the overall trend remains bullish. Traders may consider taking profits or waiting for a better entry point during the consolidation phase. It is essential to monitor key support and resistance levels for potential trading opportunities.

Recommendation:

- Short-term Traders: Consider booking profits or waiting for a pullback to enter at a better price.

- Long-term Investors: Hold positions as the overall trend is bullish, but monitor for potential entry points during consolidation.

- Risk Management: Set stop-loss orders to protect gains and manage risk effectively.

Remember, market conditions can change rapidly, so it's crucial to stay updated on the latest developments and adjust your strategy accordingly.